A couple of weeks ago, I had a conversation with a financial planner who has referred business to me for several years. This financial planner told me we need to provide asset protections in a trust for a potential client he planned to refer to me, and referenced using a revocable trust. We have these types of conversations all the time, as we have a basic understanding and how to work together. This type of conversation went beyond the basics of estate planning, sort of like this blog post is a bit higher level than a basic discussion of estate planning – this is a more specialized discussion topic. As we were chatting, I turned to my friend and asked, “What do you mean by asset protection in a revocable trust?”

He responded, “I thought when you put assets in a trust, then the assets are shielded from creditors and from someone trying to collect a judgment because the trust has a different name than the individual.” We briefly discussed how a different name would only provide protection from the most surface of inquiries, and that any creditor seeking to enforce a judgment would easily find the assets in a revocable trust. I informed him that under Colorado law, a revocable trust did not provide that type of asset protection. The idea that all types of trust create asset protection is a common misconception.

In all of my conversations with this financial planner over the years, we had never discussed what type of asset protection could be provided by a revocable trust. I let him know that a revocable trust would not provide current asset protection for the person creating the trust, and he wanted to know, “What was the point of doing asset protection in a revocable trust?” I explained that the heirs in a revocable trust could be provided asset protection for their future interest in the trust assets, but an irrevocable trust would be necessary to provide current asset protection for the person creating the trust. He seemed to understand this concept, but I wondered how many other people misunderstand asset protection, so I decided to write this blog post to address the topic.

Everybody’s goals and objectives are different and unique. The structure of a trust is determined by what you want to accomplish. Asset protection involves separating a person from assets, and therefore providing a layer of legal separation and protection for an individual and the person’s assets. Irrevocable trusts accomplish this for you if you have a current need, or revocable trusts can create this for future beneficiaries. Each approach has benefits and drawback, as does every decision, so this blog post will discuss each option.

Irrevocable Trusts Provide Current Asset Protection, but Have Trade-offs

If you are looking to protect assets from potential future creditors, then you will need to set up an Irrevocable Trust. An irrevocable trust is a trust that cannot be changed or amended without court permission, and sets up a legal wall of separation between a person and the person’s assets. Since the trust is a separate legal entity the person who created the trust no longer owns the asset and the asset cannot be reached by the creditors of that person. However, with a legal wall of separation, the person no longer owns the asset, the person also no longer has the use and enjoyment of the asset.

This can be a serious drawback. Most people do not want to give up control of their assets, and want to use their assets for themselves. Most of my clients who enter into this type of arrangement are older and trying to protect assets from Medicaid, a nursing home, or other long term care costs. There are time frames and waiting periods involved in qualifying for these programs, as well, which are discussed in this blog post about advance Medicaid planning. This type of situation probably does not apply to most younger people, so looking at other options is preferable.

In addition, if you have a current creditor, or reasonably certain future creditor – like you are in the midst of being sued – then transferring assets to an irrevocable trust will not help. Any such transfer is considered a fraudulent transfer, and can be easily undone by someone looking to collect on a judgment.

Revocable Trusts – What You Can (and Cannot) Do

Transferring assets into a revocable trust will not be a fraudulent transfer, but also does not provide immediate asset protection for the person who creates the trust. If you create the trust, control the trust as trustee, and are also the primary beneficiary of the trust, then the assets in the trust essentially still belong to you. The assets may be titled in the name of the trust, but everything flows through to you, so the assets are still open to collection from your creditors, whether current or future creditors. You are still considered the owner of trust assets for debt collection purposes.

However, a revocable trust can provide asset protection for future heirs and beneficiaries. This is often done to provide assets protection for minor children, beneficiaries who have special needs, or simply where giving a large lump sum payment may not be a good idea. A revocable trust may keep money in trust, separate from the beneficiaries or heirs, and have the money available for the use of a beneficiary under certain circumstances. For instance, if a person has special needs and cannot handle their own finances, the trust can hold onto assets and pay them out for the person’s care or well-being. The person may be receiving assistance from some sort of government program, and the program may have asset limits. By keeping the assets in trust, the person with special needs will not have the assets counted against them and the assets are protected.

By the time a revocable trust is protecting assets for the future, final beneficiaries, the person who created the trust has likely passed away, and the trust has become irrevocable, so the trust is now a separate legal entity from the beneficiary and assets are protected.

In simplest terms: a revocable trust becomes irrevocable when the person who creates the trust dies. So, the revocable trust provides asset protection when it also becomes irrevocable.

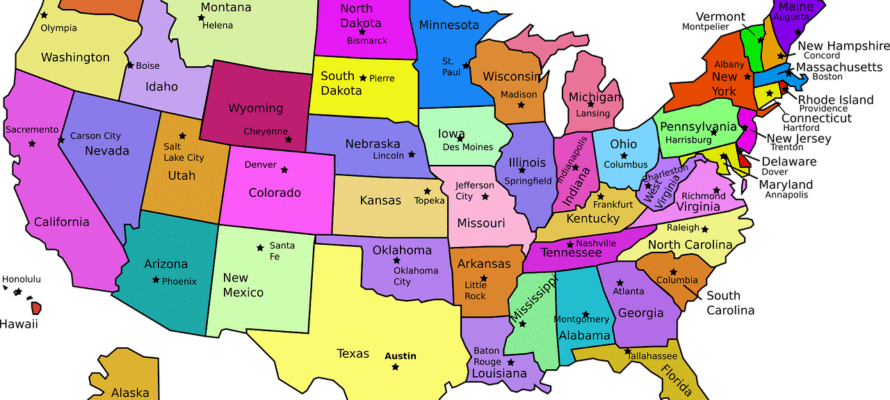

Colorado Residents: What Type of Trust is Best for You?

The question becomes, what type of trust is best for you? What fits your needs?

What you want from a trust may be different than what someone else wants. If you want to discuss your trust and what you may need, you can make an appointment now.

720-730-7274

720-730-7274

Looking into a trust for protection from my ex and to ensure any future judgements that may be against me will not affect my current wife and our assets. Also to protect whomever out lives the other (husband or wife) so that they do not have to fight with any of the children and or anyone else for any assets left behind

Hello Robert,

I am glad to hear you are looking into a trust to accomplish what you want. Please call me directly to discuss how I can help, and to discuss what trust structure would work best for you. Thank you.

Michael Bailey

I want to make an irrevocable trust for my young son. Can I be both the Grantor and the Trustee? If I am the Grantor (person making and funding the trust), and not the trustee, may I still direct the investments of the assets? I would think my son will only get the money after I die and I will give him money from my personal funds while I am alive.

Hello Dan,

This questions is best answered one on one, instead of in a public forum like this blog post. There are several considerations to consider, and I would want to know more about your goals and objectives in making the trust to be able to fully answer your question. Please contact me directly at the phone number on the website, and we can discuss the answers to your questions. Thank you.