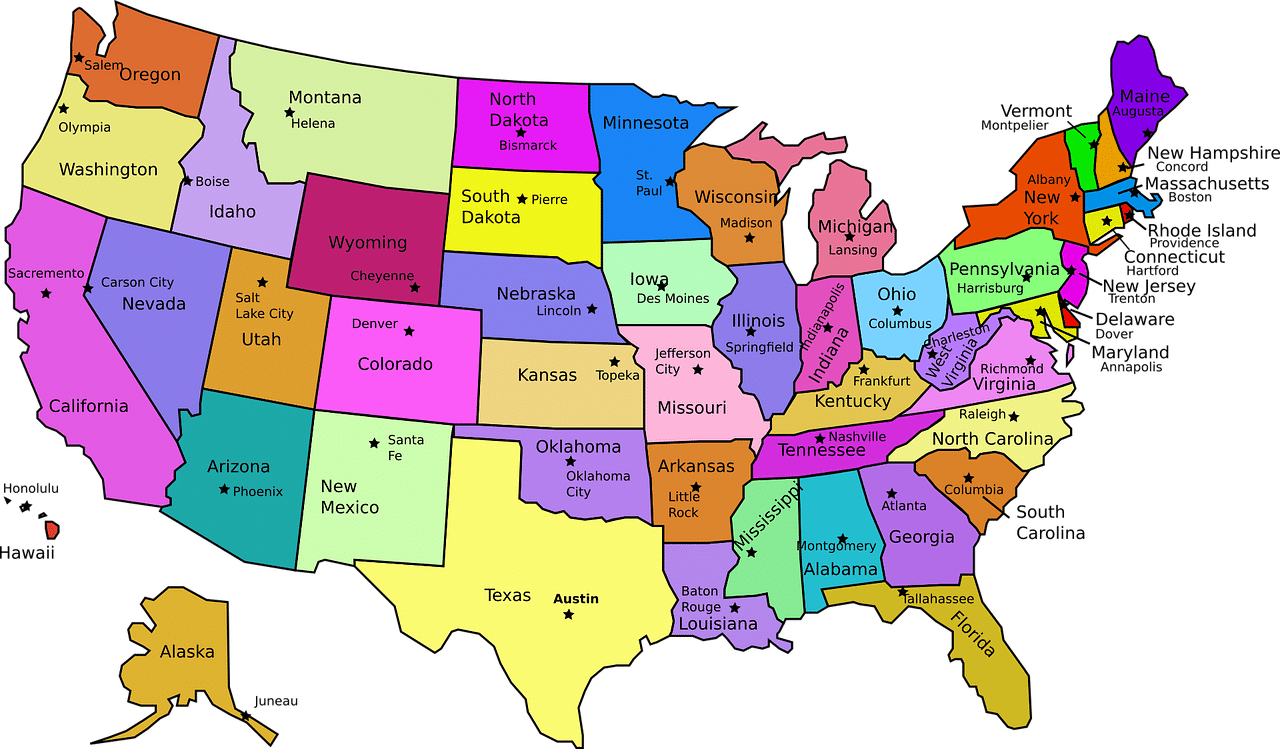

I don’t get asked this exact question all the time, but I do get different versions like: “Can you write a will for my parents? They live in Wyoming.” or “Can you write a trust for my mother who lives in California?” Often those asking the questions are clients of mine, who have relatives that live out of state. The clients are happy with what I … [Read more...]

Why AI Has Not Replaced Estate Planning Attorneys

I hear a lot in the news about AI (Artificial Intelligence) and how AI is going to replace most jobs. I am not entirely sure if that is the case, but I am sure AI will change many things about the current jobs we work, including mine. I suppose that AI will change things for the better and for the worse, but I am not sure that AI is quite ready … [Read more...]

What Is The Difference Between Estate Planning and Estate Administration?

I get calls all the time from people who tell me about a relative who recently passed away. The callers will usually tell me that they found me on the internet, or they were referred by a financial planner, or other person, who said I could help them. These callers often tell me about how they need someone to help them carry out the instructions … [Read more...]

Can You Transfer a House With a Mortgage Into a Trust?

The simplest answer to this question is yes, but that simple answer may not always be true. As I have mentioned in other blogs, there is not just one type of trust. Transferring houses or other real estate into a trust is normally a fine thing to do, especially when transferring a house into a revocable trust, which is the most common type of … [Read more...]

How To Include My Family Caregiver In My Estate Plan

My next door neighbor recently had his mother pass away. His mother lived a long, happy life, and passed away at the age of 102! 102 years is a good, long life to me. Apparently she was a woman of many talents, and long life appears to be one of those talents! My neighbor tells me that she was a tough farm woman who was not going to give up on … [Read more...]

From Grinch to Gratitude: Estate Planning That Reflects Your Wishes and Your Heart

Attorneys aren’t exactly known for being the warmest, most caring and wonderful people on the planet. Attorneys might even be described as being a little bit like the Grinch from Dr. Seuss’s story “How the Grinch Stole Christmas,” whose heart was two sizes too small. The Grinch is miserable and hates the Christmas holiday, and sometimes attorneys … [Read more...]

How to Start a Family Conversation About Estate Planning

Most families that I know don’t really want to have a conversation about estate planning, or death, or dying, or any of those unpleasant subjects. And, most families that I know don’t want to have a conversation about family finances and the family financial situation. I have found this to be especially true of older parents or grandparents. My … [Read more...]

When People Ask What My Life Meant, Tell Them This

I know many estate planning attorneys who will sell their services by telling potential clients that they want to “Leave a Legacy” or “Preserve a Legacy” for their descendants. I understand what these attorneys are saying, but I sometimes question if it is really a “legacy” that is being left in an estate plan. A person’s legacy doesn’t always … [Read more...]

Planning Before The Emotional Impact of a Death

I often discuss the virtue of planning ahead, so that you are not stuck with the default rules about who gets assets after you pass away. Many of what I discuss focuses on how you may want different things to happen with your assets than the default rules set up by the Colorado legislature, but there is a lot more to consider when death arrives … [Read more...]

Why It Is Important To Not Rush Your Will

I recently found out that August is national make your will month. I did not know that was a thing until recently, but now I know. I am not going to tell you to get your will done this month, as that would be silly and definitely be rushing things, and we don’t want to rush! The ten-time national championship and all-time great UCLA … [Read more...]

- 1

- 2

- 3

- …

- 20

- Next Page »

720-730-7274

720-730-7274