We just came out of the holiday season, which was quite busy. Whether you got invited to a lot of Christmas parties, were busy with holiday shopping, just had a million different events to go to with your children, or had big plans to celebrate the new year, the last two weeks of December are extremely busy for everyone. Now that we are in a new year, and the major end of the year holidays are behind us, it would seem that we would have more time available. Yet, there are still many distractions that get in the way of getting an estate plan done.

There are always distractions from getting your estate plan done. Needing to complete your taxes is a popular excuse I hear during the first part of the year. Certainly getting taxes done is important, but it does not need to take up all of your time. With taxes, the information you gather can even help you get your estate plan done. Essentially I am saying to you that you need to decide to get your estate plan done, and not delay for reasons that are easily overcome.

There are always distractions from getting your estate plan done. Needing to complete your taxes is a popular excuse I hear during the first part of the year. Certainly getting taxes done is important, but it does not need to take up all of your time. With taxes, the information you gather can even help you get your estate plan done. Essentially I am saying to you that you need to decide to get your estate plan done, and not delay for reasons that are easily overcome.

January is the BEST TIME to Get Your Estate Plan Done

Around the first of the year, and all the way up until mid-April, I hear about how people need to get their taxes done, and that is where their priorities lie. May I suggest that the time to get an estate plan is done now, before tax season begins in earnest. The month of January is when a lot of companies are getting tax documents ready for individual taxpayers. First, the due date for 1099s, which report income for a lot of different types of income other than wages, and W-2s, which report wages to employees, are both January 31st. So, since you can’t really start your taxes until you have those reporting documents anyhow, so January is the perfect time to get your estate plan done or updated.

Of course, getting an estate plan done while you are getting your taxes done is also a possibility. I know that working on taxes is an important endeavor, as you want to get your taxes correct. I have seen the following tax joke floating around the internet in various places:

“Government: You owe us money. It’s called taxes.

Me: How much do I owe?

Gov’t: You have to figure that out.

Me: I just pay what I want?

Gov’t: Oh, no we know exactly how much you owe. But you have to guess that number too.

Me: What if I get it wrong?

Gov’t: You go to prison.”

Certainly I do not want you to go to prison, and I don’t want you to get your taxes wrong, but I also am not sure getting your taxes done is a full-time job that prevents you from doing anything else for three and a half months.

Getting Ready for Your Taxes Can Help You With Your Estate Plan

The good news is much of the information you gather for your taxes is also relevant to an estate plan. You gather information on income for your taxes, and some of the income may come from assets you own. The value of those assets is important for an estate plan. An estate plan does involve getting information on your heirs or beneficiaries, like their address and phone number, but hopefully that information is fairly simple to locate.

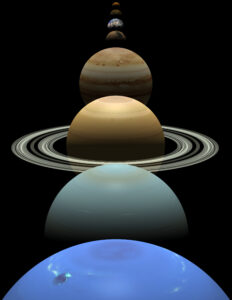

If you gather information on your assets now, you can use that information to get your estate plan started now, before your taxes become due, and you can get both important items done. Your estate plan will be done and your taxes will be filed, and you will have tremendous relief and peace of mind. You will have less distractions and less worry. Perhaps the sun will shine, birds will sing, the planets will align, and lasting peace will settle in. Please note that this is a reference to the result of musing in the movie Bill and Ted’s Excellent Adventure, and the last sentence may be a bit much, but I promise you will feel better when your estate plan is done.

If you gather information on your assets now, you can use that information to get your estate plan started now, before your taxes become due, and you can get both important items done. Your estate plan will be done and your taxes will be filed, and you will have tremendous relief and peace of mind. You will have less distractions and less worry. Perhaps the sun will shine, birds will sing, the planets will align, and lasting peace will settle in. Please note that this is a reference to the result of musing in the movie Bill and Ted’s Excellent Adventure, and the last sentence may be a bit much, but I promise you will feel better when your estate plan is done.

Overcome Current Distractions and Get Your Estate Plan Done Now

There is always a distraction or a reason to put off doing your estate plan. In December it was the holidays, now it is taxes, and in the summer there are vacations. Whatever you may tell yourself as an excuse, you need to choose to get your estate plan done, or you never will. There is no time like the present. Get it done, update it as necessary, and be prepared.

720-730-7274

720-730-7274