My last name is Bailey, so I am familiar with many of the Irish traditions associated with St. Patrick’s Day, and also familiar with the concept of the “luck of the Irish.” I am familiar with the four-leaf clover, the pot of gold at the end of the rainbow, and how if you catch a leprechaun, you can have the leprechaun’s pot of gold. I have never found a four-leaf clover in the wild. I know enough about the physics of light refraction to understand that the end of the rainbow will almost never be on the ground where you can see it. And, I have never seen a leprechaun. I am told leprechauns are fictional creatures, but if leprechauns do have pot of gold to give away, I will keep looking for one. The movies I have seen about leprechauns show they are slippery, sneaky creatures, so I may never spot one in my life, but I will keep on the lookout!

My last name is Bailey, so I am familiar with many of the Irish traditions associated with St. Patrick’s Day, and also familiar with the concept of the “luck of the Irish.” I am familiar with the four-leaf clover, the pot of gold at the end of the rainbow, and how if you catch a leprechaun, you can have the leprechaun’s pot of gold. I have never found a four-leaf clover in the wild. I know enough about the physics of light refraction to understand that the end of the rainbow will almost never be on the ground where you can see it. And, I have never seen a leprechaun. I am told leprechauns are fictional creatures, but if leprechauns do have pot of gold to give away, I will keep looking for one. The movies I have seen about leprechauns show they are slippery, sneaky creatures, so I may never spot one in my life, but I will keep on the lookout!

I do know leprechauns aren’t real, but I can still dream about the pot of gold. Clearly looking out for a leprechaun is a little bit of fantasy on my part, but it is just a bit of harmless fun. My ancestors came from England and Ireland, so I can hold onto a bit of a silly belief concerning leprechauns, but I certainly don’t claim to be an expert and know everything about St. Patrick’s Day or all of the traditions. I do know that you don’t want to leave your estate planning up to luck.

If you don’t write your own estate plan, the State of Colorado has been kind enough to enact legislation that dictates where your assets will go after you pass away. These rules are known as “intestate” succession, which means to die without a will. The rules are written much like any statute and can be confusing and convoluted. The rules may also not do what you want to have happen. It is much better to write your own estate plan instead of relying on the Colorado statues to distribute your assets.

What Does the Colorado Intestate Statute Say?

If you print out the Colorado intestate statute, it is approximately 90 pages long. The rules cover a lot of different situations, not all of which may apply to you, but navigating 90 pages of legislature speak can be daunting. For those who have simple situations – you have one spouse, and all of your kids are from that spouse – the Colorado intestate rules say that everything will go to your spouse, and if your spouse is deceased, then to the children, in equal portions.

Not everyone has that simple of a situation. Many people have been married more than once, or have children from different marriages or relationships. If that is the case, then the Colorado intestate rules have a formula that gives different amounts to your current spouse and children from a previous relationship. Your current spouse gets one amount, and a different amount or percentage goes to the children from a different relationship.

If you don’t have children, or other descendants, then the Colorado intestate rules will start looking up and out to find your closest living relatives, so your parents, or siblings, or aunts and uncles, or nieces and nephews would be the recipients of your assets. If you don’t name someone to carry out the plans in your estate, the State of Colorado can appoint someone to search out your closest living relatives.

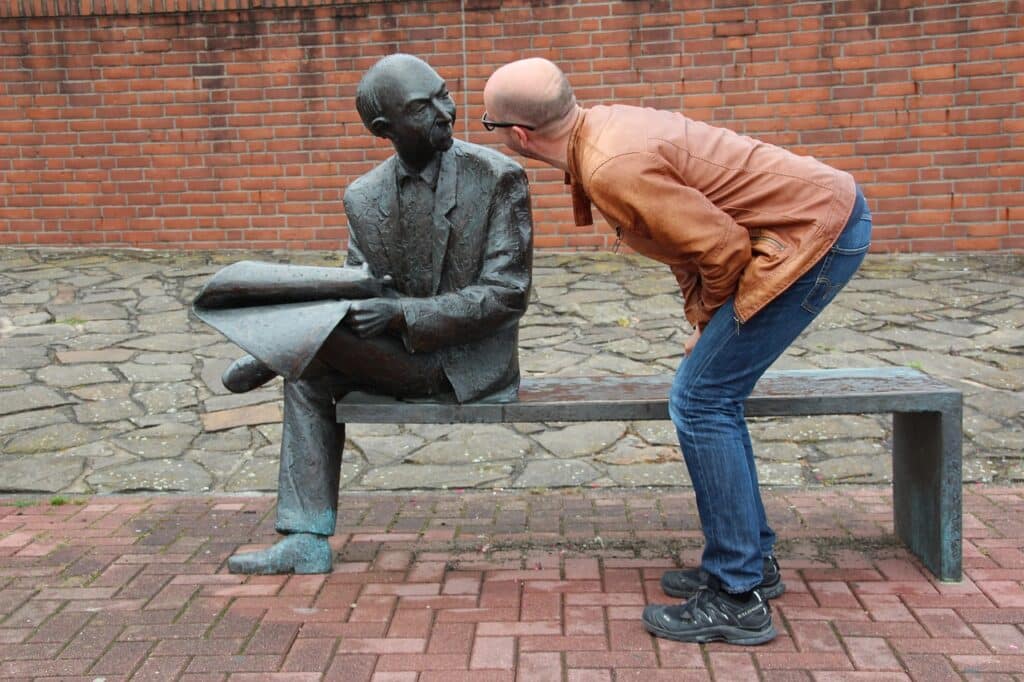

Whatever money you do have will need to be spent on such a search, and if the State of Colorado is unable to find your relatives, then the money will just go to the State of Colorado. I don’t know about you, but I am not sure I fully trust the government to do a thorough search, if it is just easier for them to find nobody and say, “Well, I guess the money is ours,” and that would be the end of it. Perhaps I view the government investigators as having a little bit of leprechaun in them – a little bit of slippery and sneaky in them, so I may be more skeptical than most. I am sure many of you trust the government more than I do, but if the government benefits by not finding anyone to get your assets, the government’s incentives don’t look so great.

Preparing Your Own Estate Plan Just Works Better

Instead of relying upon the Colorado intestate statutes and trying to decipher all of the ins and outs of those rules, you can just write your own estate plan to dictate what happens to your assets. When you write down what you want in your own will and trust, and you pick who you want to carry out your wishes, you are out from under the default rules, and you can make it easier on everyone to know exactly what you want to do.

The Colorado intestate rules are great rules to have in place as a backup…for cases where someone died unexpectedly, or before they had a chance to make a proper will or trust, but the intestate rules are unlikely to do everything you want. You can clearly and simply write down who you want to receive assets in your own will and trust, and in doing so, ensure your wishes are followed, and that the people or entities you want to receive assets will get them, not the wrong people or entities.

You can also pick who you want to carry out your wishes. You can choose a trusted family member or friend. Or, you can choose a professional fiduciary to handle carrying out your plans. You don’t need to leave the person to carry out your plan to the government, or to chance. You don’t need to pick a leprechaun, or rely on luck. You can choose who you trust to carry out your plans for after you die.

When you make your own estate plan – you choose who gets what and who is in charge. Don’t leave those decisions up to luck!

Make Your Own Luck in Your Estate Plan

You don’t want to leave your estate plan up to luck, or to the default rules. You can make your own luck! You don’t need a four-leaf clover, or a pot of gold, you just need to decide for yourself. If you leave your estate plan up to the Colorado intestate statutes, it could be a little like letting a leprechaun guide you to the answer – with lots of twists and turns, wrong ways, and potential mistakes. Instead, let an experienced estate planning attorney help guide you, and give you a map with a straight path to what you want. No luck needed! To make an appointment to talk to an experienced estate planning attorney, click the button below.

720-730-7274

720-730-7274