It is October, and Halloween is coming up. A couple of years ago my four year old asked what a friend of ours would be for Halloween by asking, “What will Erazz be for Halloween? A witch!” He mispronounced our friend Mirazz’s name, and made us laugh, but picking a costume is always a fun part of Halloween. Picking an estate plan may not be as fun as a Halloween costume, but comparing the two is why this blog exists, so let’s get to it:

As a little kid, candy was pretty important to me, so I had to pick the right costume. I wanted to get as much candy as possible, as quickly as possible on Halloween and the right costume was necessary, as it needed to be both cool and functional. I would run between houses and ring the doorbell, say “Trick or Treat,” collect my candy, say “Thank you,” and run off to the next house. Getting candy was still the end goal, and I always loved dumping out the bag of candy at the end of the night to see what I had obtained.

Picking a costume = setting up an estate plan? Definitely!

I think the process of picking a costume is a little like setting up an estate plan. While sifting through candy on Halloween night is a little bit like what happens to people who inherit something from a relative. Yes, there are major differences between Halloween candy and an inheritance. But, the focus in this blog post is how Halloween costumes and candy and estate planning are alike.

Picking a costume is like picking an estate plan. Not everybody’s costume is the same, and neither is your estate plan. On Halloween, you can choose to be a ghost, goblin, a pirate, or anything you want to be, while an estate plan can choose a will, trust, or other method. Even within those methods, not all documents are the same, just like not all costumes are the same. If you are a ghost for Halloween, you could be a friendly ghost like Casper, or a scary ghost. The same is true for your estate plan. However, the end goal of estate planning is to distribute assets, like Halloween costumes are about Trick or Treating.

Different Costumes = Different Trusts or Wills

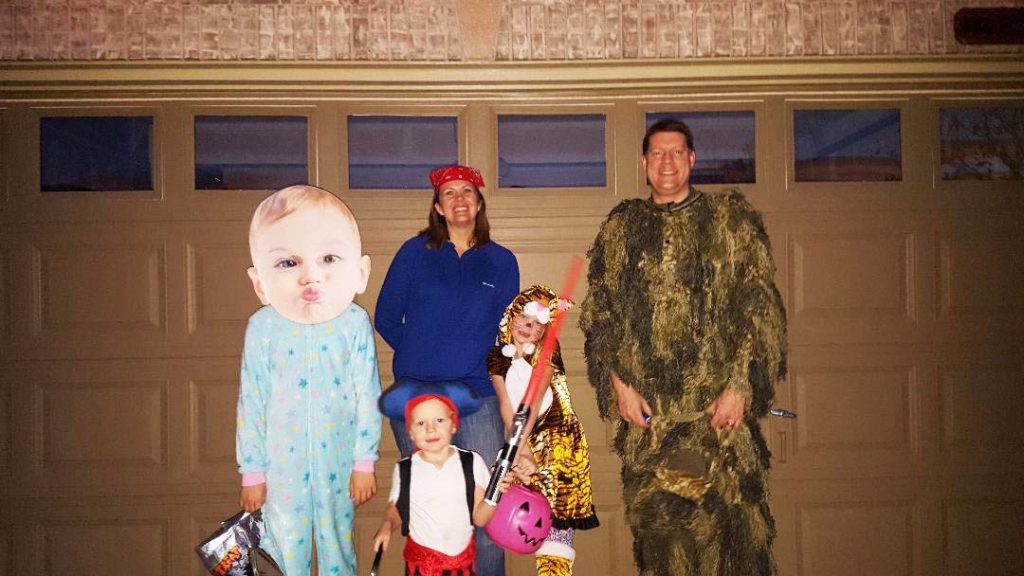

Almost everyone that I know picks a different costume for Halloween. Families can dress up as a theme, or individually. My family was the characters from the Wizard of Oz one year. As parents we thought that was great. But, my children have stronger opinions on costumes now. Apparently themes don’t work quite as well for my family now. Different costumes still allow my children to go collect candy as we Trick or Treat, so the end goal of getting candy is the same, but the costume is different.

Similarly, when you pick the form of an estate plan, they are not all the same. A basic will gives your assets away when you die. A more complex will can give away assets when you die, but the more complex will can have a more sophisticated distribution pattern. A will that sets up a contingent or testamentary trust at your death is still a will, but such a will is more complex than a simple, or basic will. All three types of will mentioned here are called wills, just like the generic term costume describes all types of costumes on Halloween, but costumes are not all the same in how they look and are created. The final goal of setting up an estate plan is the same, to get assets to the heirs, but each will is different in how is it set up, just like all costumes are a bit different.

Trusts – They’re Not All the Same, and Neither Are You…or your Halloween Costumes!

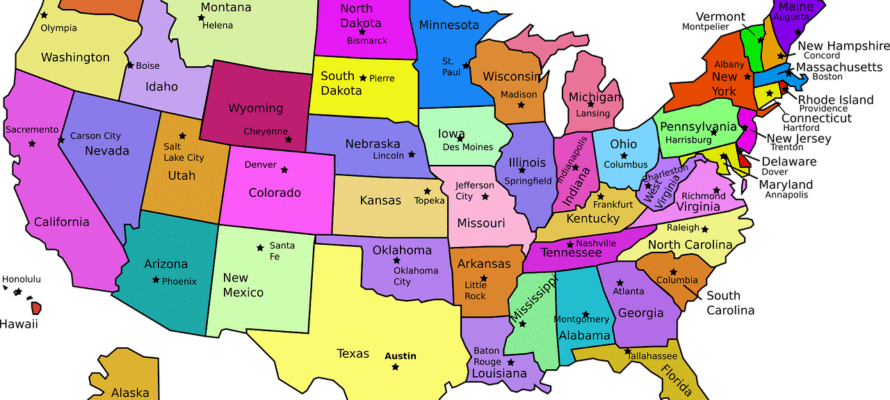

Although a trust shares the same final goal of distributing property to the heirs at death, trusts are both different from themselves, and also different from wills. Revocable trusts are quite useful to avoid probate, especially if set up for property in more than one state. Revocable trusts are also useful for reducing income tax that might become due on 401(k), IRA, or other assets that are for retirement accounts. This is what we refer to as “qualified money.” Setting up a trust is not the same for everyone.

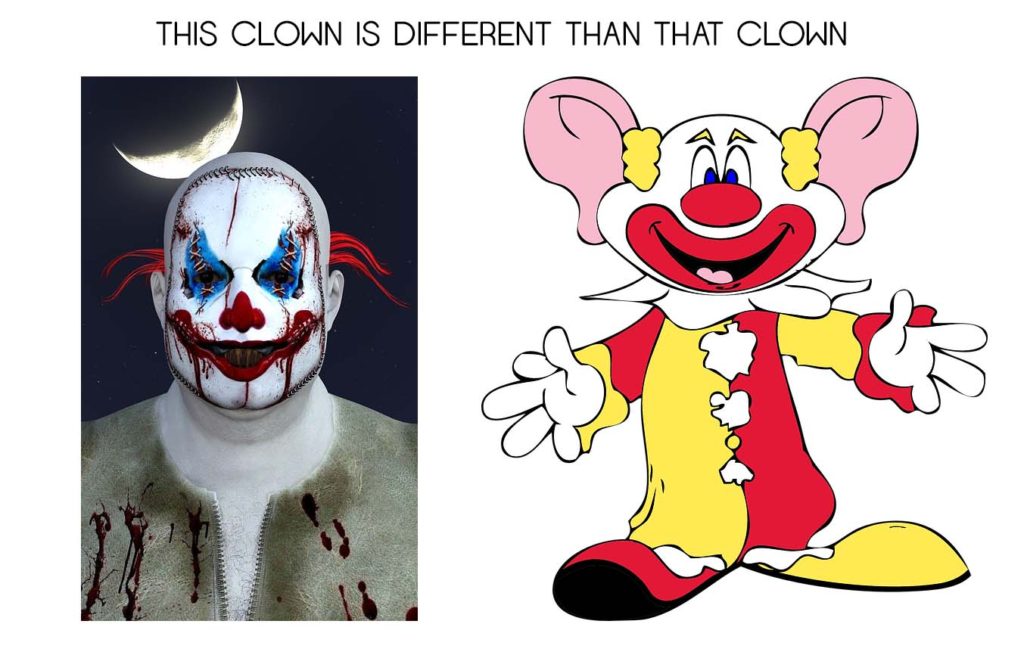

A trust is not a one size fits all proposition, just like a all Halloween costumes are not the same, even if they are called the same type of costume. Someone may dress up in a clown for Halloween, but not all clowns are the same:

A trust can accomplish different purposes for people, but still be called a trust, just like both clown costumes pictures above are clowns, but they are not the same.

Many times revocable trusts are set up to control assets after someone dies, so that assets are not simply distributed outright to the beneficiaries or heirs. There are many reasons why setting up a trust could be a good idea, including preserving assets for minor, or disabled children, or simply to ensure a smooth transition of money to the beneficiaries or heirs. Just like people pick their own Halloween costumes for a specific purpose, you can pick the right type of trust to accomplish your purpose.

Scary Clown or Friendly Clown? What Type of Trust Do You Need?

Trust can be revocable, or irrevocable; each type has unique characteristics, like different Halloween costumes – to entertain, scare, or just to get candy, I suppose.

Revocable trusts do not provide asset protection in Colorado. If you are looking to protect assets from future creditors, or things like long term care medical costs, Medicaid, accidents, or other threats to your assets, an irrevocable trust may be the correct answer. Just like a clown costume will not be what you are looking for if you want to be a ghost for halloween, you need to pick the right type of trust to accomplish your purpose.

Revocable trusts do not provide asset protection in Colorado. If you are looking to protect assets from future creditors, or things like long term care medical costs, Medicaid, accidents, or other threats to your assets, an irrevocable trust may be the correct answer. Just like a clown costume will not be what you are looking for if you want to be a ghost for halloween, you need to pick the right type of trust to accomplish your purpose.

An irrevocable trust has a different structure from a revocable trust. Revocable trusts allow you to retain control over your assets in the trust, whereas irrevocable trusts give control of assets to the Trustee, who should not be you in most asset protection cases. Using irrevocable trusts is a powerful tool, but must be used correctly and with a full understanding of what type of trust is best for your situation. You want to pick the right trust, like you want to pick the right costume. I remember the silly picture, this meme, showing what happens if you pick the wrong type of dress up for a party, where one is in a spiderman costume, and the other attendees are in formal dresses; the same is true for picking the right trust. You need to pick what is right for you and your situation.

Examining Your Candy, or Figuring Out the Distributions

Kids love to dress up for Halloween, but let’s face it: Trick or Treating is about the candy, while for you the end goal of an estate plan is to distribute assets. Just like you need an estate plan to distribute assets, and you need a costume to get Halloween candy.

Wills and trusts are administered differently. I liken the differences in administration to sifting through Halloween candy as a kid. If I dumped out my candy in front of my siblings, they wanted to take some or trade for the candy they liked, and as a parent, I have been known to grab a piece of my children’s candy as a “Daddy Tax.” If I wanted to keep my candy safe from everyone else, I dumped it out in my own room for inspection, away from everyone else. I then had to keep my candy hidden to keep it protected.

When a will goes through probate, it becomes a public document, able to be examined by anyone who goes through the proper channels to request a copy. This is usually a non-issue as most people do not generally care who inherits from a deceased person. However, many of the rules of law we have regarding wills come from deceased individuals who had large estates, or were famous, or made mistakes in what they did in a will, so the will was challenged. This is somewhat like opening candy in front of your siblings and parents. Everything is open for everyone to see. If privacy is important to you, then a trust may be the way to go.

When a will goes through probate, it becomes a public document, able to be examined by anyone who goes through the proper channels to request a copy. This is usually a non-issue as most people do not generally care who inherits from a deceased person. However, many of the rules of law we have regarding wills come from deceased individuals who had large estates, or were famous, or made mistakes in what they did in a will, so the will was challenged. This is somewhat like opening candy in front of your siblings and parents. Everything is open for everyone to see. If privacy is important to you, then a trust may be the way to go.

A trust is a private document, not one that is available for the whole world to see. Beneficiaries of the trust are entitled to know the contents of a trust, especially as it relates to what they should receive and what conditions are in the trust concerning distributions to a beneficiary. However, the private nature of a trust is definitely something to consider if you do not want to go through probate, or have the prying eyes of the public see your financial affairs after you die. This is kind of like opening candy in your room, so that only those you allow to see the candy will be able to do so.

Choosing The Right Costume (Estate Plan) for You

Obviously there are many more aspects to choosing a will or trust, or the correct form of a trust, that are not discussed here. The best way to know what type of will or trust is right for you and your situation is to discuss your situation with an experiences estate planning attorney, who can help you know what will work best for you. Just like you need your parents’ help to get a costume when you are kid, you can use an estate planning attorney to help to pick the right estate plan for you.

720-730-7274

720-730-7274

I simply love the festival n Halloween. the costume should be amazing and scary too. lovely article thanks for sharing it.