I cannot tell you how many times I have heard people tell me that they already have a will, so they are all set. I understand why those who tell me this may think it is true, but I do not completely agree. A will is only effective once you pass away, and only gives someone power to handle your assets and transfer assets to your named beneficiaries after you are deceased. If you are still alive, then a will does not give someone the power or authority to act on your behalf if you are unable to do so yourself. The will is a critical part of your estate plan, but the will is not the only thing that needs to go into a complete estate plan.

I cannot tell you how many times I have heard people tell me that they already have a will, so they are all set. I understand why those who tell me this may think it is true, but I do not completely agree. A will is only effective once you pass away, and only gives someone power to handle your assets and transfer assets to your named beneficiaries after you are deceased. If you are still alive, then a will does not give someone the power or authority to act on your behalf if you are unable to do so yourself. The will is a critical part of your estate plan, but the will is not the only thing that needs to go into a complete estate plan.

From my perspective, estate planning is not just about setting up what happens to your assets after you die, but also about how we get from here to there. As much as I would like to believe that everyone lives happily and healthily until the time they die, that is just not the case. Mental decline is the reality of longer life, and many, if not most, people will experience some sort of degradation in their mental capacity if they live long enough.

My own grandmother suffered from alzheimer’s disease / dementia for the last 10 years of her life. It advanced to such a degree that she did not know who I was or realize that she had grandchildren at all. I can recall answering the phone as a high schooler, and having my grandmother ask for my dad by name, but not even realizing who I was. I didn’t get my feelings hurt, but if my grandmother did not realize her children were married and she had grandchildren, that was one piece of the puzzle to figure out that she probably was not really capable of making sound financial or medical decisions for herself.

Fortunately, my grandmother had set up a financial power of attorney and a medical power of attorney that let my aunt make decisions on her behalf. The financial power of attorney gave my aunt power to make financial decisions when my grandmother was incapable of making her own financial decisions. The medical power of attorney gave my aunt power to make medical decisions when my grandmother was incapable of making her own medical decisions. The powers of attorney allowed my aunt to take over such things while my grandmother was alive, not just when she was deceased, like a will would do. Since we all may become mentally incapacitated at some point, we all need financial and medical powers of attorney, just like my grandmother did.

What Does a Financial Power of Attorney Allow You to Do?

A financial power of attorney allows the person you designate to make decisions for you – called your agent – to make any and all financial decisions on your behalf while you are incapacitated. The agent is bound by law to act in your best interest, so the agent is restrained from just doing whatever they want, as they are required to act in a manner that would best serve you. Your agent can pay your bills, talk to the companies that provide services to you (like the power company, water company, landscaping service, or trash service companies), and communicate with your bank and other financial institutions. The agent will also be able to access the funds in the bank accounts and other financial institutions to make payments and use the funds for your care of the care of your house, car, or other assets. The agent can decide to keep the same investments you have, or can sell off something like a stock that is dropping in value to protect your assets and preserve them.

A financial power of attorney allows the person you designate to make decisions for you – called your agent – to make any and all financial decisions on your behalf while you are incapacitated. The agent is bound by law to act in your best interest, so the agent is restrained from just doing whatever they want, as they are required to act in a manner that would best serve you. Your agent can pay your bills, talk to the companies that provide services to you (like the power company, water company, landscaping service, or trash service companies), and communicate with your bank and other financial institutions. The agent will also be able to access the funds in the bank accounts and other financial institutions to make payments and use the funds for your care of the care of your house, car, or other assets. The agent can decide to keep the same investments you have, or can sell off something like a stock that is dropping in value to protect your assets and preserve them.

This does give the agent power and control over your assets, but it also allows your agent to take care of you. If you are alive, but mentally incapacitated, it is good to have someone who can take care of your financial needs and act on your behalf in financial matters. You do need to carefully pick an agent who is trustworthy and capable of handling such matters. You want someone who understands you and what you would want to do, but has enough knowledge to handle financial matters when you cannot do so yourself. The financial power of attorney allows your agent to act on your behalf while you are alive, but mentally unable to make your own decisions. Having the financial power of attorney that allows someone to act on your behalf while you are still alive is vital to ensure you are cared for even if you become incapacitated.

What Does a Medical Power of Attorney Allow You to Do?

A medical power of attorney allows your agent to make medical decisions on your behalf while you are alive, but mentally incapable of making decisions. Your agent can make decisions concerning what course of treatment to pursue, give informed consent for medical tests and procedures, and discuss your health situation with your doctor. A medical power of attorney can contain a HIPAA waiver to allow your agent to discuss your private health information with the doctor as part of the power of attorney, or the HIPAA waiver may be a separate document. An agent is not required to have medical training or extensive medical knowledge, but rather should be someone who is capable of handling medical decisions.

A medical power of attorney allows your agent to make medical decisions on your behalf while you are alive, but mentally incapable of making decisions. Your agent can make decisions concerning what course of treatment to pursue, give informed consent for medical tests and procedures, and discuss your health situation with your doctor. A medical power of attorney can contain a HIPAA waiver to allow your agent to discuss your private health information with the doctor as part of the power of attorney, or the HIPAA waiver may be a separate document. An agent is not required to have medical training or extensive medical knowledge, but rather should be someone who is capable of handling medical decisions.

Not everyone is willing or able to handle those types of decisions. Some people get queasy at the sight of blood, or freeze when asked to make medical types of decisions – these are not the best candidates to become your medical power of attorney agent. Instead, you want to pick someone who can listen to the doctors and nurses and make good decisions concerning your medical care based on discussions with your doctor. Someone who dislikes or distrusts doctors may not be the best candidate to be your agent!

These decisions are also made in the context of what would be best for you, not just whatever your agent wants to do. Your agent needs to have an understanding of what you might want to do and how you would like to be treated as a patient. This allows your agent to act in your best interest and act as closely to what you would if you could make your own medical decisions. You definitely want to have a medical power of attorney in place to ensure your medical needs are met while you are alive.

What Happens If No Powers of Attorney Are Set Up?

If you don’t set up a financial or medical power of attorney prior to the time that you become incapacitated, then you take the chance that nobody will be allowed to make decisions on your behalf when you become incapacitated. If you have no powers of attorney, someone can petition the court to become appointed as your guardian or conservator to make decisions on your behalf. A guardian can make decisions concerning your life, and a conservator can make decisions concerning your money. Both processes can take time to work their way through the courts, and both processes can be significantly more expensive than setting up a power of attorney. It is definitely good that both processes exist for the case that no power of attorney is present. But, if you plan ahead, you can save time, money, stress, and headache by having your powers of attorney set up before a crisis hits because you become incapacitated.

If you don’t set up a financial or medical power of attorney prior to the time that you become incapacitated, then you take the chance that nobody will be allowed to make decisions on your behalf when you become incapacitated. If you have no powers of attorney, someone can petition the court to become appointed as your guardian or conservator to make decisions on your behalf. A guardian can make decisions concerning your life, and a conservator can make decisions concerning your money. Both processes can take time to work their way through the courts, and both processes can be significantly more expensive than setting up a power of attorney. It is definitely good that both processes exist for the case that no power of attorney is present. But, if you plan ahead, you can save time, money, stress, and headache by having your powers of attorney set up before a crisis hits because you become incapacitated.

Plan Now, Plan Ahead, and Be Ready

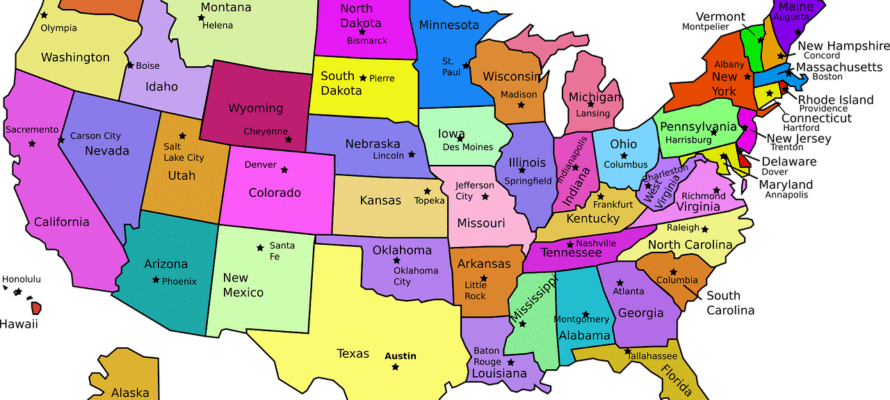

Since nobody knows when they may become incapacitated, it is best to plan now and be prepared for the possibility of not being able to make your own decisions in the future. Your financial and medical powers of attorney can be set up now, and just remain dormant until they are needed. It is better to have a power of attorney and not need it, than to need a power of attorney and not have one. If you would like to set up a power of attorney as part of your estate plan, or all by themselves, click the button below to make an appointment to get started.

720-730-7274

720-730-7274