The simplest answer to this question is yes, but that simple answer may not always be true. As I have mentioned in other blogs, there is not just one type of trust. Transferring houses or other real estate into a trust is normally a fine thing to do, especially when transferring a house into a revocable trust, which is the most common type of trust that people set up. Even transferring mortgaged real estate assets into an irrevocable trust can be done (even if such a transfer isn’t as quite as simple).

The simplest answer to this question is yes, but that simple answer may not always be true. As I have mentioned in other blogs, there is not just one type of trust. Transferring houses or other real estate into a trust is normally a fine thing to do, especially when transferring a house into a revocable trust, which is the most common type of trust that people set up. Even transferring mortgaged real estate assets into an irrevocable trust can be done (even if such a transfer isn’t as quite as simple).

When transferring a house or other real estate assets, most people get concerned about the mortgage needing to be paid off all at once or refinanced because of the transfer. This concern stems from what is known as a “due on sale” clause, which is a standard and common clause in a mortgage. Basically a “due on sale” clause means that whenever a house or real estate property changes ownership, any remaining amount due on a mortgage immediately becomes due. Certainly you don’t want to have a mortgage become due immediately upon transferring a house into a trust, as most people don’t just have the money to pay off the balance due on a mortgage all at once.

While I understand the concern, the structure of a revocable trust means the mortgage should not become due immediately, which is a good thing for most people. Transferring a house with a mortgage is certainly something that needs to be carefully considered. The mortgage needs to be accounted for in transferring a house to a trust. Simply because a mortgage exists on a house doesn’t mean the house cannot be transferred. And even once a house is in a trust, that may not be the end of the story, as mortgages on houses inside of trusts are still something that requires vigilance and planning. But, the good news is that you can generally transfer a house to a trust even if it has a mortgage on it without facing negative consequences.

Mortgages are Tied to The House and to the Owner

A mortgage on a house is connected to both the owner and the real estate property – the house. An individual borrows the money, but the loan is secured by the house and land the house is on – the real estate. A bank or other lending institution that lends money to a person wants to ensure they are paid back. The bank or other lending institution knows the land is valuable, so the bank is willing to lend money knowing that if the loan is not repaid, the bank can reclaim the land and the house from the borrower, and then sell the land and the house to recoup the money lent out to the individual. The bank cannot repossess land that is not owned by the individual who borrowed the money, so the bank is quite careful to ensure the bank’s interest is secured by the land or the house in the form of a mortgage. Thus, if an individual is trying to sell or transfer a house or real estate to someone else, the bank wants to ensure they get paid back in the transaction.

A mortgage on a house is connected to both the owner and the real estate property – the house. An individual borrows the money, but the loan is secured by the house and land the house is on – the real estate. A bank or other lending institution that lends money to a person wants to ensure they are paid back. The bank or other lending institution knows the land is valuable, so the bank is willing to lend money knowing that if the loan is not repaid, the bank can reclaim the land and the house from the borrower, and then sell the land and the house to recoup the money lent out to the individual. The bank cannot repossess land that is not owned by the individual who borrowed the money, so the bank is quite careful to ensure the bank’s interest is secured by the land or the house in the form of a mortgage. Thus, if an individual is trying to sell or transfer a house or real estate to someone else, the bank wants to ensure they get paid back in the transaction.

This is why a “due on sale” clause exists, to keep the bank safe and protected from losing money after the money was lent out to an individual, and why the bank cares who owns the property. The bank needs to secure its interest in the property, so the bank doesn’t want a house or other real estate property to be transferred to someone who didn’t borrow money from the bank. This is why a transfer of real estate to a third party means the bank wants to be paid back and why transferring real estate to a trust can be seen as a problem.

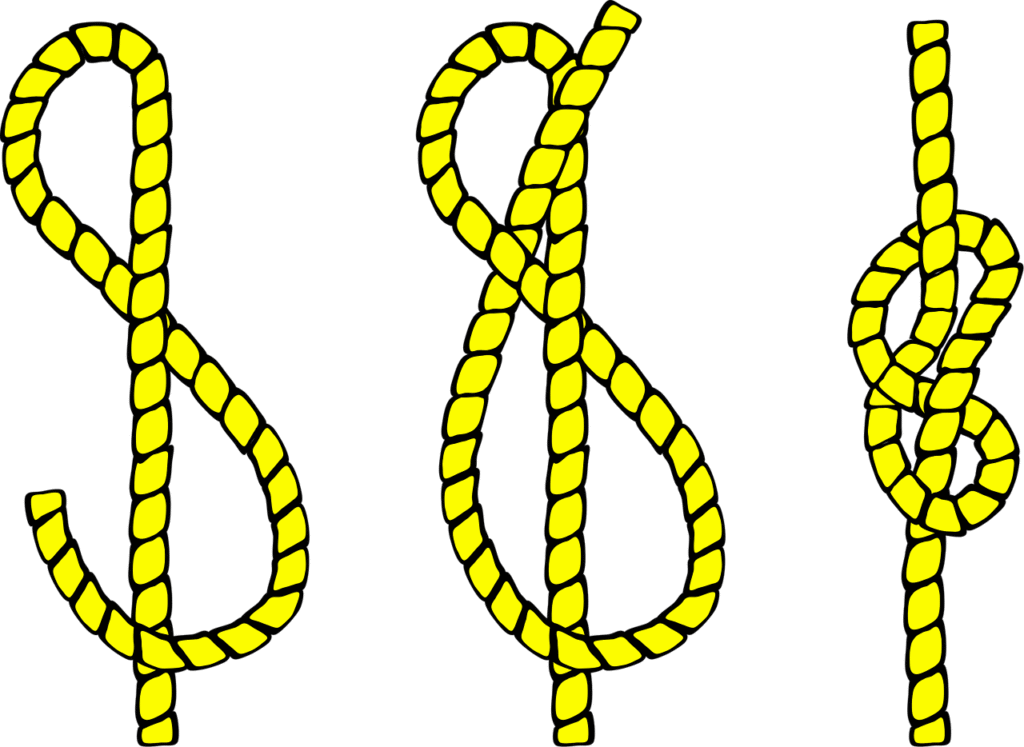

Understanding What Type of Trust You Are Using

If you are transferring a house or other real estate into a revocable trust, you should not need to worry about a mortgage on the property. If you create the revocable trust, you are the trustee of the trust, and you are the beneficiary of the trust while you are alive, then you are essentially transferring the house from you to you, just with the trust as the official owner on paper. Because you control the entire trust, and you control the property, you are still the one who is in charge of, and responsible for, the house and paying the mortgage. As such, banks and other mortgage lenders do not implement the “due on sale” clause if you put your house into your own revocable trust.

If you are transferring a house or other real estate into a revocable trust, you should not need to worry about a mortgage on the property. If you create the revocable trust, you are the trustee of the trust, and you are the beneficiary of the trust while you are alive, then you are essentially transferring the house from you to you, just with the trust as the official owner on paper. Because you control the entire trust, and you control the property, you are still the one who is in charge of, and responsible for, the house and paying the mortgage. As such, banks and other mortgage lenders do not implement the “due on sale” clause if you put your house into your own revocable trust.

Some irrevocable trusts become their own entities, and a transfer from you, as an individual, to your trust, as a separate entity, can lead banks or other mortgage lenders to see this as a full transfer of ownership from you to another entity, which can trigger the “due on sale” clause, and cause you to need to pay off the mortgage all at once, or refinance the mortgage in the name of the trust. Of course, not all irrevocable trusts are created equal, so if you are looking to create an irrevocable trust for some reason, and you want a house with a mortgage to go into the trust, you need to explore a type of irrevocable trust that will allow you to maintain enough control over the house for you to still be considered the owner of the house and avoid the “due on sale” clause. This may, or may not, be possible in what you are trying to do with an irrevocable trust, so you will need to balance the reasons you are wanting to set up an irrevocable trust with the consequences of transferring a house to such a trust if the house still has a mortgage attached to the house.

Putting a House With a Mortgage in a Trust Isn’t the End of the Story

At the risk of stating the obvious – Once a house with a mortgage is transferred into a trust, the mortgage still needs to be paid. A house with a mortgage can still be repossessed or foreclosed on by the bank or other lending institution even if it is in a trust, so the payments still need to be made. When payments aren’t made, the banks tend to be less happy and want to get paid, which does seem fair.

In addition, when someone who created a trust passes away, and ownership transfers from the trust to the beneficiary of a trust, any remaining mortgage needs to be paid at that time, as the death beneficiary of a trust is not the same person as who bought the house or put it into the trust, at least that is trust almost all of the time. Oddly enough (or completely normally enough), putting a house into a trust isn’t a way to avoid paying a mortgage! If you could avoid paying a mortgage by putting a house into a trust, everyone would do it, and banks would lose lots of money, so they wouldn’t lend any money to anyone. Putting a house in a trust doesn’t cut off a bank’s ability to protect itself, so it is possible to put a house with a mortgage into a trust, and still keep everyone happy.

Are You Ready To Talk With An Experienced Estate Planning Attorney?

Transferring your house into your estate plan, revocable or irrevocable trust may seem like a daunting task. I am here to help you with transferring your house into your estate plan we have created together. Contact me today by clicking the link below.

720-730-7274

720-730-7274