I get a lot of questions from people about how to start the process of setting up a will. I often inquire as to whether they want to start the process of drafting a will, or whether they are asking about what type of decisions go into a will and what they should be thinking about as they start a will. The answer to starting drafting a will is fairly simple – you can write it yourself, or you can meet with an attorney to get your will prepared. In either case, when you start drafting your will, there are certain questions you should think about prior to starting the drafting process. These are the answers to the “what type of decisions go into a will” question.

The first thing you want to think about is: Who do you want to receive your assets / possessions / things when you pass away?

Next, you should consider who do you want to leave in charge of distributing everything when you pass away?

Lastly you want to consider whether you want to have any restrictions on others receiving assets when you are gone.

I do have an intake worksheet that I give to potential clients to help them consider these types of questions and how they want to answer the questions for themselves. You can access the intake worksheet by clicking here:

1) Who Should You Give Assets to After You Pass Away?

This is the most fundamental question you need to answer concerning a will is who will get assets after you die? In many cases, this can be a fairly easy answer. If you are married, you can leave assets to your spouse. If you have children, you can leave assets to your children. However, not every marriage is a first and only marriage, and not every family has children that are the biological offspring of both spouses in a marriage.

Planning for a second, or subsequent marriage, is something that takes a little bit more planning, as the decisions on who gets what assets may not be as simple as previously described. Some assets may go to a surviving spouse, while others may need to be given to the children from a previous relationship. The decision of who should receive assets is one you need to make for yourself, or make along with your spouse. Despite what I keep being asked, I cannot decide who gets assets for you, as that is outside of what I am able to do. You know your family situation, and I do not, so you need to decide how to split up your assets as you want to have happen.

For those who are not married, or don’t have children, the decision on who gets assets can be more complex. Some people want to leave assets to their other relatives, like nieces, nephews, brothers, sisters, or even parents. There is nothing wrong with wanting to leave assets to those types of people, and they make sense if you don’t have anyone else to whom you want to leave assets. Other people want to leave assets to charities they support, and believe that doing so will be more beneficial than leaving assets to family members they don’t really know, or don’t want to enrich after their deaths.

Leaving assets to charities is also a perfectly viable alternative. You just need to choose for yourself who you want to benefit in your will. That is not a decision to me made lightly, or without thinking. Many times specific items that have sentimental value are given to specific family members, or specific people who will appreciate the sentimental value or other virtues of a specific item. Such specific gifts need to be thought out, as well. You don’t want a family heirloom going to the wrong person who won’t appreciate it. You need to choose who gets your assets, so that they end up where the assets should be.

2) Who Should Be In Charge of Distributing Assets After You Pass Away?

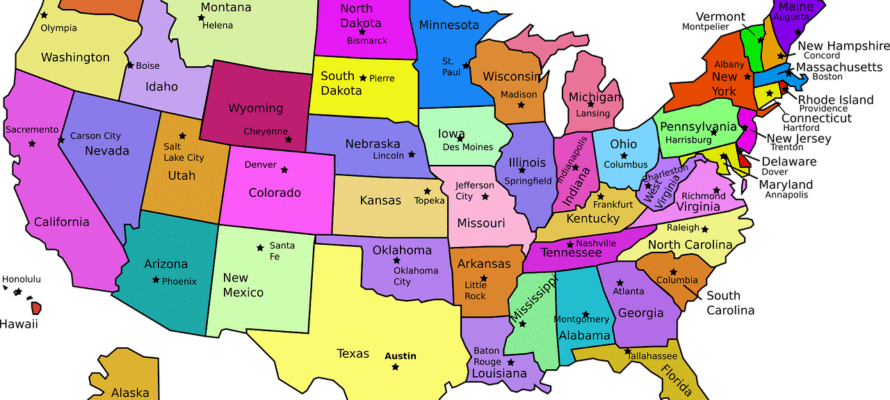

While it is vital to know who will receive assets after you pass away, who will be left in charge of distributing those assets is also very important. The person in charge of a will is called a “personal representative” in Colorado, but is referred to as an executor or executrix in other states. The personal representative is responsible for submitting the will to the probate court, applying for probate, going through all the steps of probate (like paying off debts that the deceased person owed, closing out accounts, and giving an accounting to the court of assets in the estate and expenditures), and distributing assets to the named beneficiaries.

This can be an important job and the person who gets picked to handle the job should be someone trustworthy, organized, capable of handling money and financial decisions, and also able to communicate with the named beneficiaries in a clear and efficient manner. Going through the probate process can take time, and the biggest complaint I hear from beneficiaries of an estate is that the personal representative is taking too long, and not telling them anything. If a personal representative communicates with the named beneficiaries and lets the beneficiaries know what is happening and what the time frame is for the next steps to happen, then most of the problems beneficiaries have with how a personal representative is acting on behalf of the estate will not become big issues. The combination of someone who can handle interacting with the court, financial institutions, and communication with beneficiaries is an important thing to think about when deciding who will be in charge of your estate after you have passed away.

The person in charge of a trust once you are gone is known as a successor trustee and has similar responsibilities, save that the successor trustee does not need to take a trust to the probate court, as a trust is a private document.

3) Do You Want Any Conditions or Restrictions on the Distributions?

Although it is not quite as important as who gets assets and who is in charge, you want to decide if you want your named beneficiaries to receive assets outright, or if you want to put conditions or restrictions on the distributions. If you have minor children, you may not want to have all of the assets go to the children until they are old enough to handle the assets. If you have beneficiaries who are mentally or physically disabled, then you may want to consider using a special needs trust to preserve money for them, Or, if you have a beneficiary who is addicted to some sort of substances, and you don’t want assets to be used for those self-destructive types of behaviors, you can restrict when and how distributions are made to ensure the distributions are used to benefit the person you want to help and not used to harm them.

Such restrictions on distributions usually can be done by using the right type of trust, so if you have conditions or restrictions on distributions, then a trust may very well need to be part of your estate plan. I have discussed trusts in my other blog posts, so I will not go into detail here, but if you think you may want to set up a trust, we should meet and discuss what type of trust would work best for you.

Get Started With Your Will By Answering the Right Questions for Yourself

Once you have the questions above answered for yourself, it is time to start drafting your will, or trust if you need one. You can answer the questions on your own, or you can use my intake worksheet to guide you through the process. Once you have the questions answered, you can reach out to me to get started on drafting a will. You can make an appointment to meet with me by clicking the button below.

720-730-7274

720-730-7274